40 what is a stock buyback

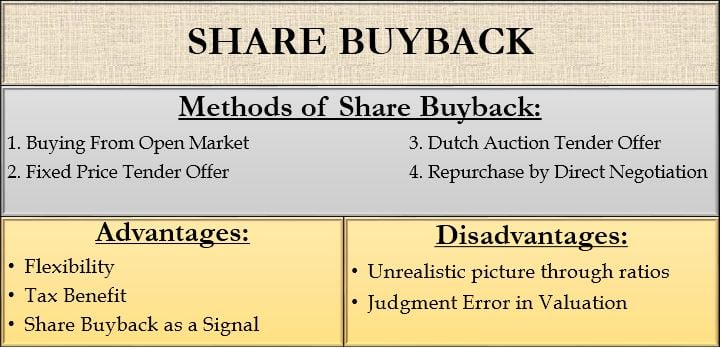

Stock Buyback Methods - Overview, Reasons, Methods A stock buyback (also known as a share repurchase) is a financial transaction in which a company repurchases its previously issued shares from the market using cash. Since a company cannot be its own shareholders, repurchased shares are either canceled or are held in the company's treasury. › market › mark-to-marketWhat does TCS’ buyback mean for its stock Jan 13, 2022 · A buyback may lead to some earnings dilution but considering the size of TCS, this is too small to provide any significant upside trigger to the stock," said an analyst with a domestic brokerage ...

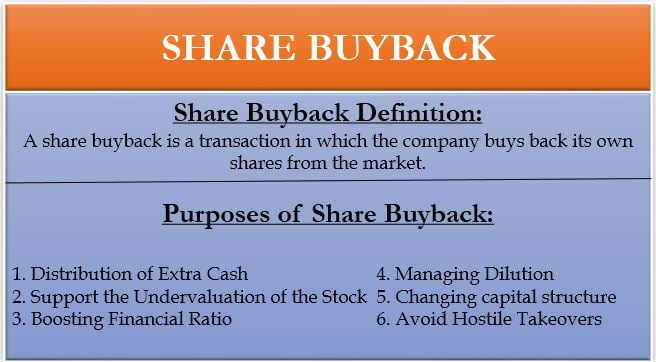

What Is a Stock Buyback, and Why Is It so Controversial ... A stock buyback occurs when a company buys back its shares from the marketplace. Buybacks are essentially a form of investing, but instead of shareholders backing a company, the company elects to reinvest in itself. Buybacks can also serve as an opportunity for companies to give back to shareholders since fewer outstanding shares on the market ...

What is a stock buyback

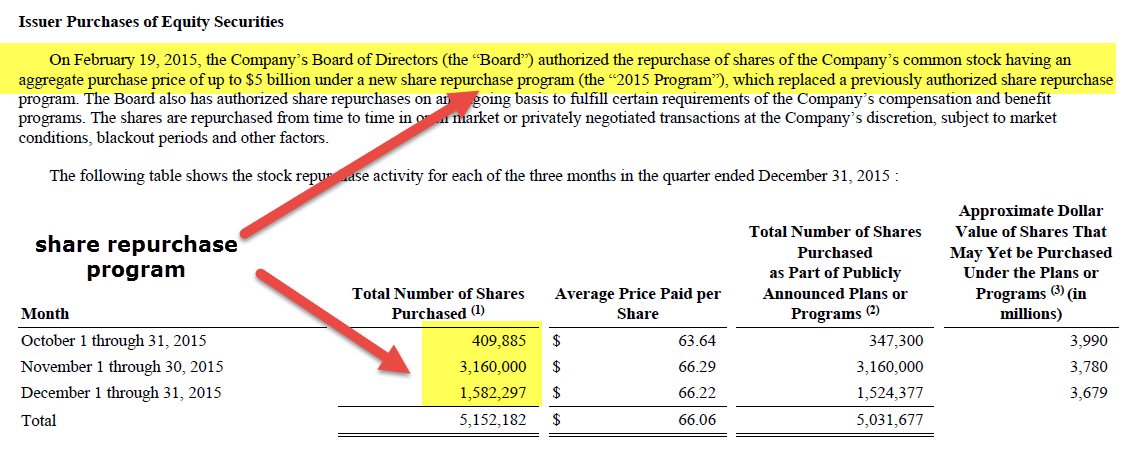

› news › 22/02/25681891NVR, Inc. (NYSE:NVR) - NVR Adopts $500M Stock Buyback Program ... Feb 17, 2022 · NVR Inc (NYSE: NVR) Board has authorized the repurchase of $500 million of its outstanding common stock.; The purchases will occur from time to time in the open market and/or in privately ... Alibaba's Upscaled Buyback May Be a Sign of Things to Come Alibaba stock surges on share buyback program, Okta stock hit by reports of possible data breach Yahoo Finance Live's Julie Hyman and Brian Sozzi discuss news moving Alibaba and Okta stocks. 2h ago › terms › sShare Repurchase Definition Dec 15, 2021 · A share repurchase, or buyback, is a decision by a company to buy back its own shares from the marketplace. A company might buy back its shares to boost the value of the stock and to improve the ...

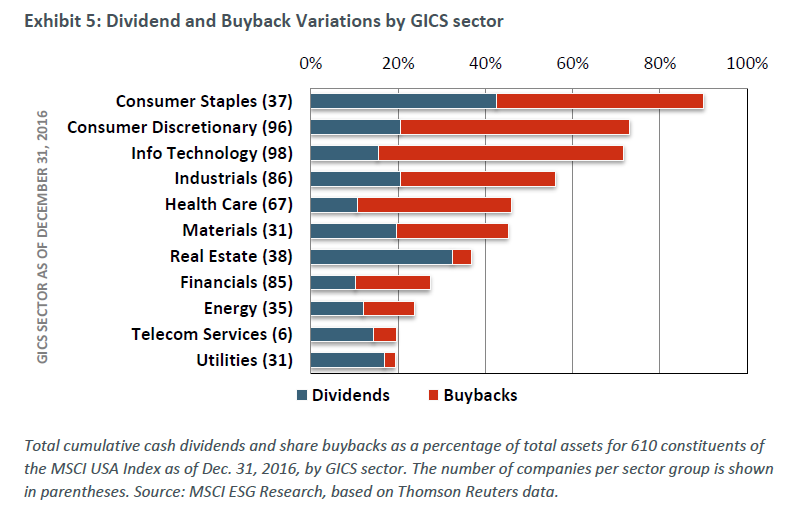

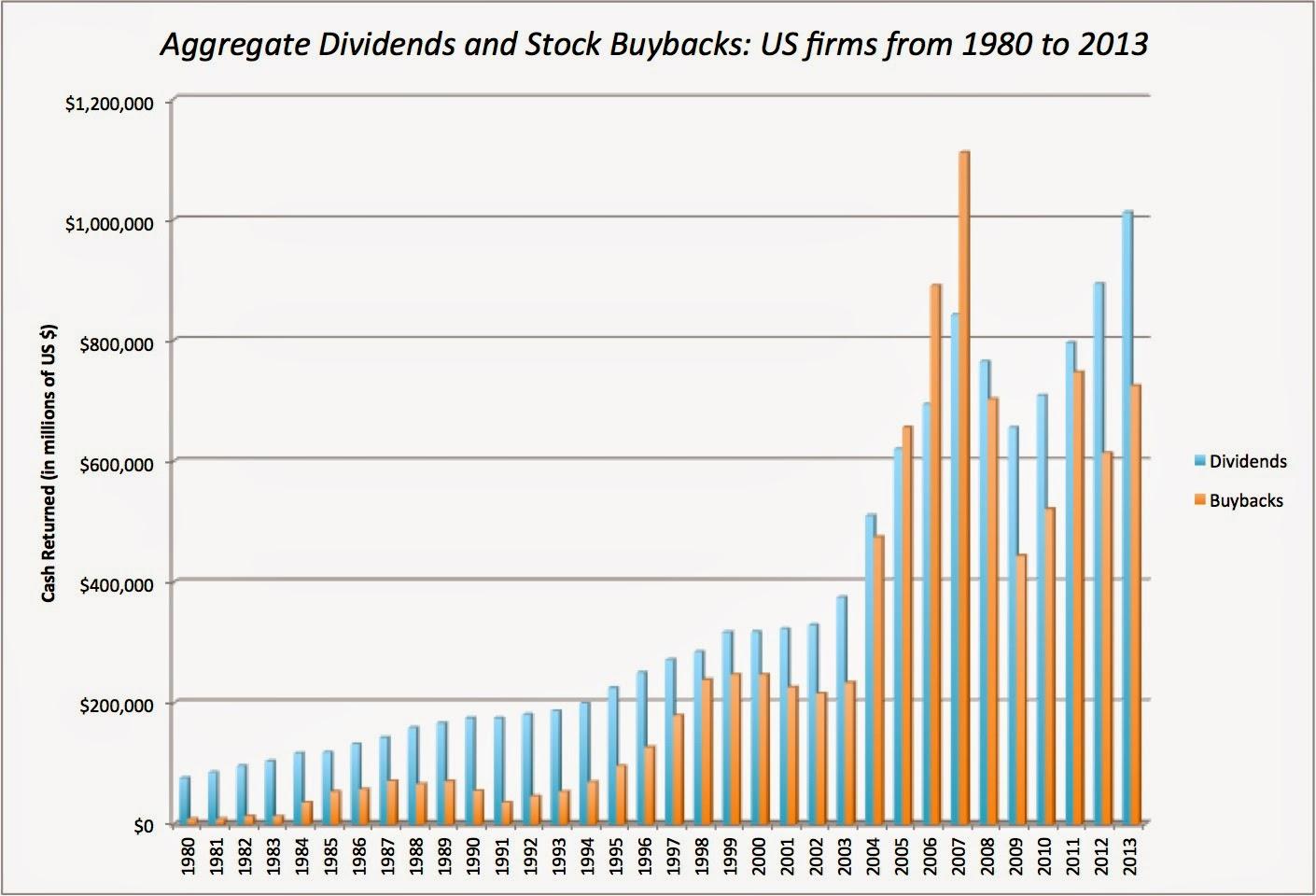

What is a stock buyback. What Is a Stock Buyback? - SoFi A stock buyback is when the company that issued the stock in the first place decides to buy back a number of shares from its shareholders. When there are fewer total shares on the market, the value of each share typically appreciates thanks to the laws of supply and demand. What are Stock Buybacks and How Do They Work? - TheStreet A stock buyback is when a company does just that - buys back shares of its own stock. Public companies do so quite often. U.S. companies purchased $710 billion of their own shares of stock ... Stock Buyback: What Is It and How Does It Work ... A stock buyback can improve a company's financial metrics, making it more attractive to shareholders and merger or acquisition partners. Buying back stock reduces the amount of cash on a company's balance sheet, which improves its return on assets metric. It also decreases the amount of equity, improving the return on equity metric. What is a Stock Buyback? Definition & Benefits of Share ... A stock buyback (or share repurchasing) is when a company buys back its own stock, often on the open market at market value. Much like dividends, a stock buyback is a way of returning capital to the stockholder. Its main incentive is to reduce the company shares on the market.

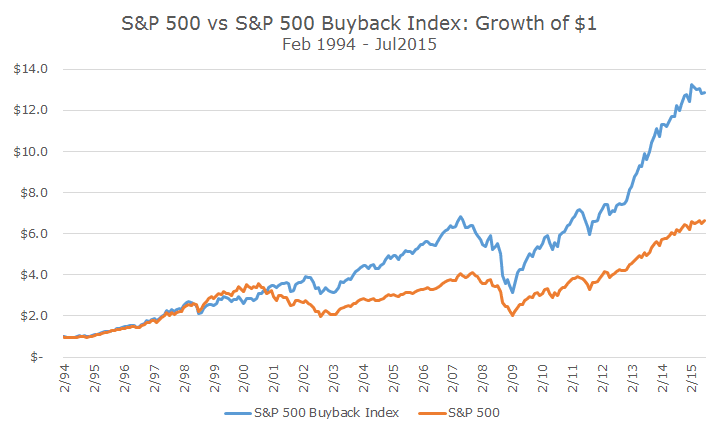

What Stock Buybacks Mean to Investors | InvestingAnswers Also called a share repurchase program, stock buybacks are a way a company returns wealth to the shareholder by purchasing outstanding shares of its own stock.A stock buyback is generally conducted in one of two ways: buying shares in the open market over time or tendering an offer to existing shareholders to buy shares at a fixed price. Most commonly the company will repurchase shares of its ... What is a stock buyback? | finder.com A stock buyback occurs when a company buys back its shares from the marketplace. Buybacks are essentially a form of investing, but instead of shareholders backing a company, the company elects to reinvest in itself. Buybacks can also serve as an opportunity for companies to give back to shareholders since fewer outstanding shares on the market ... finance.yahoo.com › news › amazon-surges-stock-splitAmazon surges as stock split, buyback excite investors Mar 10, 2022 · The company on Wednesday announced a 20-for-1 stock split, its first since 1999, and a $10 billion share buyback. It comes on the heels of a similar split announced by Alphabet Inc earlier this year. Are Stock Buybacks a Good Thing or Not? - Investopedia A buyback will create a level of support for the stock, especially during a recessionary period or during a market correction. A buyback will increase share prices.

What Is a Stock Buyback? - Dividend.com - Dividend.com P/E, or price to earnings ratio, is the most popular measure to value companies in the stock market. It's defined as price of the company divided by earnings per share. The P/E before the buyback was 10 ÷ 1 = 10. The P/E after the buyback would be 10 ÷ 1.04 = 9.61, thus, making the share undervalued. Companies can buy back their shares if ... What Is a Stock Buyback Program? | Finance - Zacks A stock buyback program is a highly effective tool deployed by companies seeking to raise the value of their shares. An increase in the price per share of a company and decrease in the number of ... What's a Stock Buyback? (2022) Beginner Guide, A-Z A stock buyback is a way for a company to re-invest in itself. To make up for the lower profit distribution, it can reduce the money allocated to the stock buybacks instead of the dividend payments. According to prevalent market theories, reducing the buybacks will have a much lower impact on the stock price. stockmarket.com › featured › stock-market-today-dowStock Market Today: Dow Jones, S&P 500 Opens Lower; Upstart ... Feb 16, 2022 · [Read More] Top Stock Market News For Today February 16, 2022. Upstart Shares Surge Following Blowout Quarterly Figures And Upbeat Guidance; Announces $400 Million Share Buyback. Among the hottest names in the stock market today would be Upstart (NASDAQ: UPST). This seems to be the case as UPST stock is gaining by over 30% at today’s opening ...

finance.yahoo.com › video › amazon-announces-20-1Amazon announces 20-for-1 stock split, $10 billion share buyback Mar 09, 2022 · Amazon announced a 20-for-1 stock split and up to $10 billion share buyback. Video Transcript. RACHELLE AKUFFO: Well, we have some breaking news for you guys now based on Amazon. Now Amazon is ...

What Is a Stock Buyback? As an Investor, Should You B ... Stock buybacks reduce the number of a company's shares trading on the open market. A company may buy back its stock if it thinks its share price is undervalued or too cheap. It's debatable whether stock buybacks are beneficial for investors over the long term. The stock buyback: Some say it's the gift that keeps on giving (depending on ...

What Is A Stock Buyback? - Forbes Advisor A stock buyback is when a public company uses cash to buy shares of its own stock on the open market. A company may do this to return money to shareholders that it doesn't need to fund ...

Buyback Definition A buyback is when a corporation purchases its own shares in the stock market. A repurchase reduces the number of shares outstanding, thereby inflating (positive) earnings per share and, often, the ...

What Is a Buyback? - The Balance A stock buyback occurs when a company buys outstanding shares of its own stock with excess cash or borrowed funds. A buyback increases the value of outstanding shares; it reduces the number of total shares on the market, which increases the earnings per share (EPS). One alternative is to pay dividends to investors.

What Are Stock Buybacks and How Do They Work? Stock buybacks are when companies repurchase shares of their own stock. Recent examples include: When a company has excess cash it can buy its own shares back from the market. Fewer shares ...

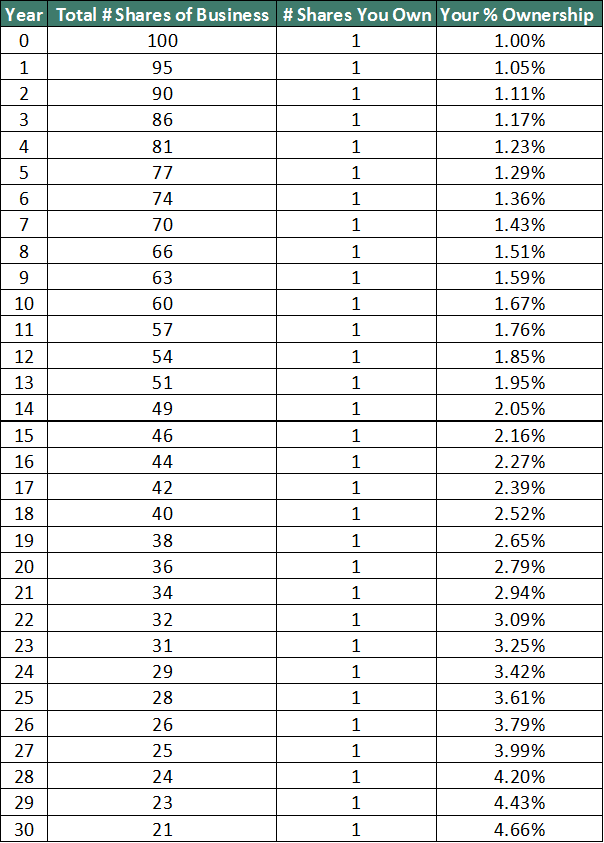

Stock Buybacks: Examples, Definition & Benefits Stock buybacks (also called share repurchases or stock repurchases) are when a publicly traded business uses cash to buy back some of its outstanding shares. Stock buybacks reduce the amount of shares outstanding. This is good for the remaining shareholders. An example is below.

What is a Stock Buyback? - Wealthsimple A stock buyback allows a company to invest in itself and consolidate ownership. It's also a way to return wealth to investors without increasing dividends. This can be important if the stock price is devalued, or a recession looms on the horizon. Buying back shares of its own stock can be the best use of capital at a particular time.

Stock Buybacks: Why Do Companies Buy Back Shares? A stock buyback affects a company's credit rating if it has to borrow money to repurchase the shares. Many companies finance stock buybacks because the loan interest is tax-deductible .

› articles › 02Stock Buybacks: Benefits of Share Repurchases May 24, 2021 · No-Ratio Mortgage: A mortgage program in which a borrower's income isn't used or reported in qualifying the borrower for the mortgage under the standard debt-to-income ratio requirements. The loan ...

What Are Share Repurchases? - The Motley Fool But shareholders do benefit indirectly from a buyback or repurchase program, as the goal is generally to raise the company's stock price. The idea is that by taking shares out of circulation, the ...

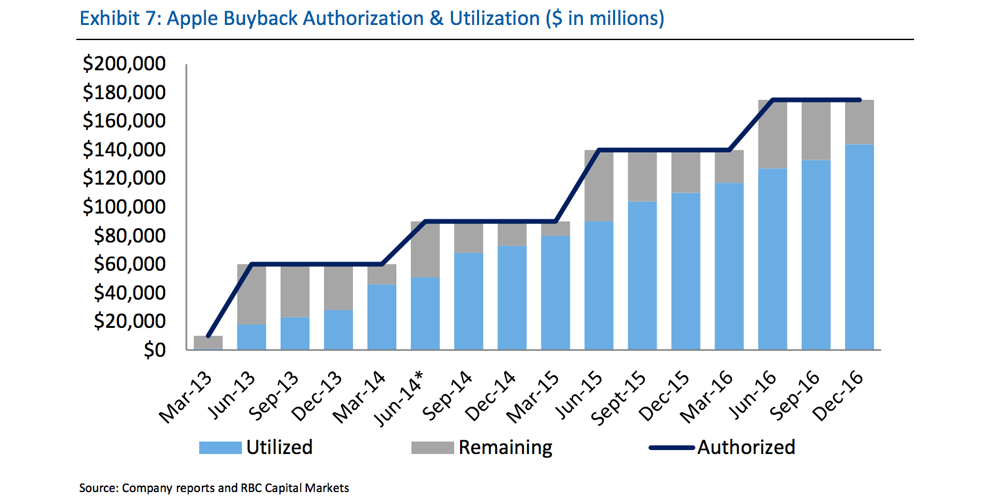

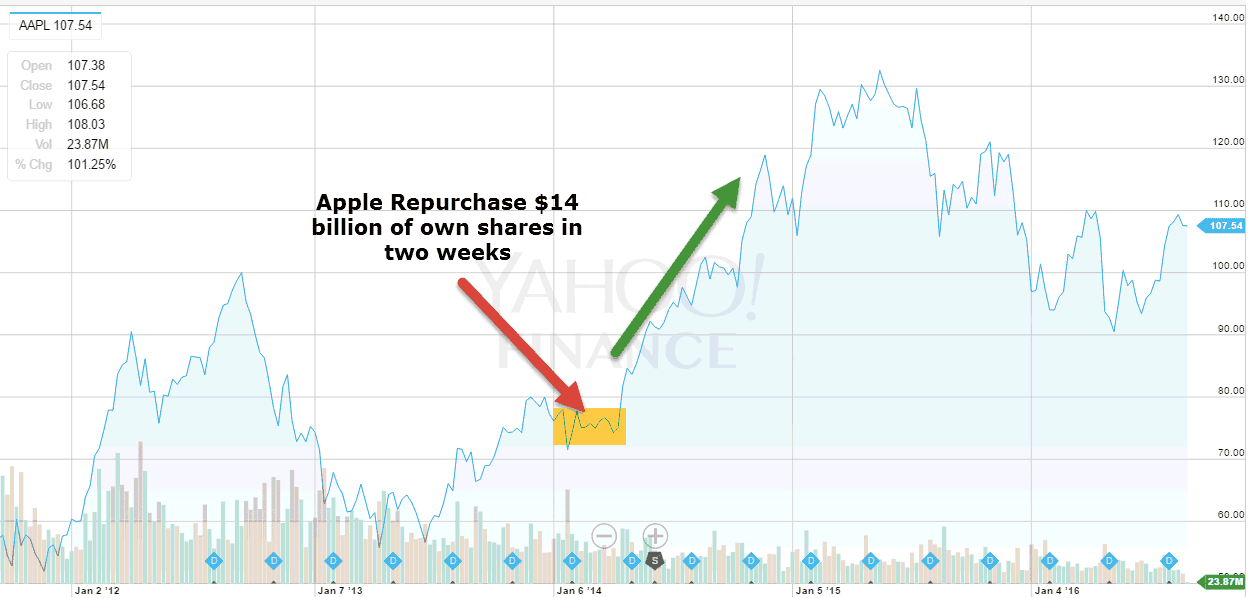

Stock Buybacks - What It Means When a Company Repurchases ... Stock buybacks, often referred to as share buybacks or share repurchases, are repurchases of stock in the open market by the issuing company. That's right, if Apple announces a share buyback, it means that the company plans on using some of its mounds of cash to buy its own stock back.

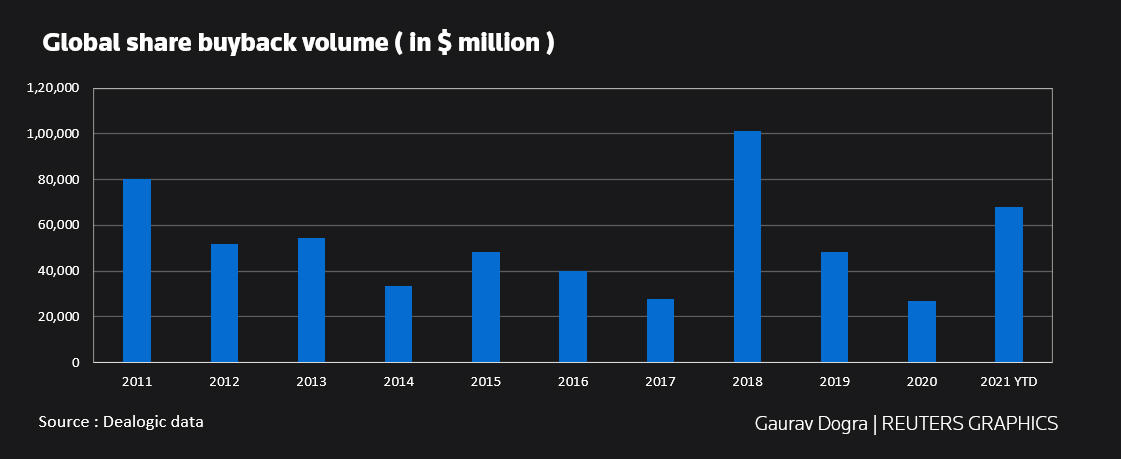

Tax on Stock Buybacks a Misguided Way to Encourage Investment Erica York. Erica York. Stock buybacks have gained a bad rap in recent years as policymakers have blamed them for a range of economic ills, from encouraging a focus on short-term profits to reduced investment. Now, Senators Ron Wyden (D-OR) and Sherrod Brown (D-OH) have targeted buybacks for a 2 percent excise tax in the reconciliation package.

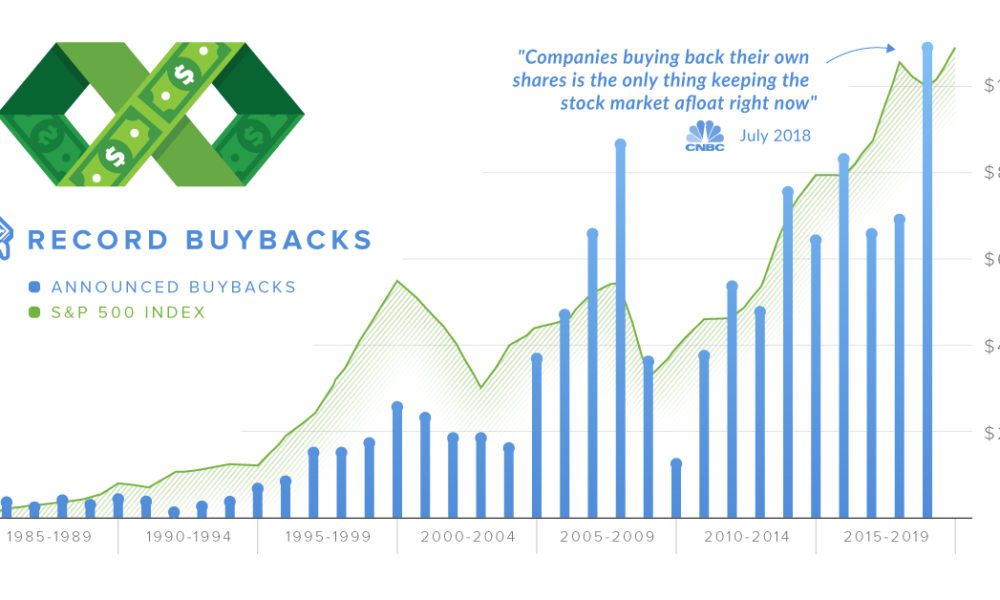

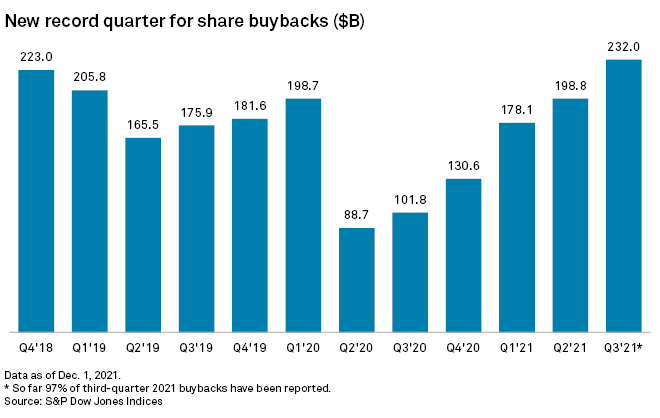

How Stock Buybacks Work | The Motley Fool Roughly 95% of stock buybacks take place on the open market. Open market buybacks have the ability to move a stock's price. Basic supply and demand economics says that a surge in demand (like a ...

What Is a Stock Buyback? Everything You Should Know About ... Stock buybacks are also a great way to influence the supply and demand to increase a firm's market value. By buying back their outstanding shares, the earnings per share will increase, the demand for the shares will increase, and the value of the shares in the marketplace will also increase.

How Stock Buybacks Work and Why Companies Do Them - SmartAsset Stock buybacks occur when a publicly traded company decides to purchases large swaths of its own stock. There are a variety of reasons a company may do this. Reducing cash outflows and countering a potential undervaluing of shares are potential reasons.

› terms › sShare Repurchase Definition Dec 15, 2021 · A share repurchase, or buyback, is a decision by a company to buy back its own shares from the marketplace. A company might buy back its shares to boost the value of the stock and to improve the ...

Alibaba's Upscaled Buyback May Be a Sign of Things to Come Alibaba stock surges on share buyback program, Okta stock hit by reports of possible data breach Yahoo Finance Live's Julie Hyman and Brian Sozzi discuss news moving Alibaba and Okta stocks. 2h ago

› news › 22/02/25681891NVR, Inc. (NYSE:NVR) - NVR Adopts $500M Stock Buyback Program ... Feb 17, 2022 · NVR Inc (NYSE: NVR) Board has authorized the repurchase of $500 million of its outstanding common stock.; The purchases will occur from time to time in the open market and/or in privately ...

/Screenshot2020-04-14at11.17.32AM-6d8cfcd249bd4cfa94ba0343bc2f3426.png)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10464797/deloitte.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/11907067/jackson_insider_stock_buybacks.png)

:max_bytes(150000):strip_icc()/Screenshot2020-04-14at11.17.32AM-6d8cfcd249bd4cfa94ba0343bc2f3426.png)

0 Response to "40 what is a stock buyback"

Post a Comment