42 w4 form 2022

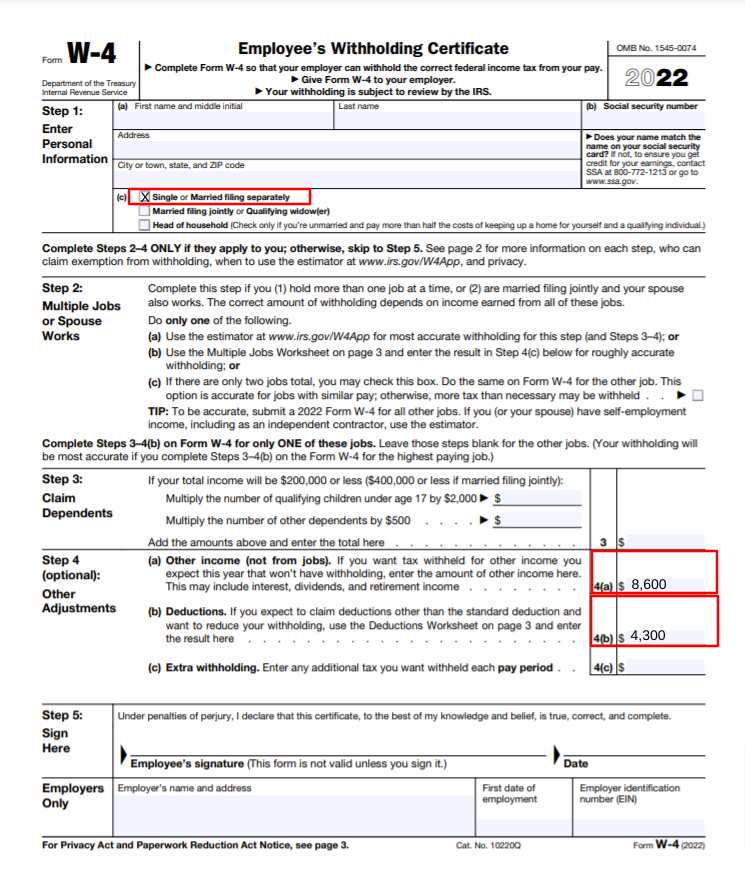

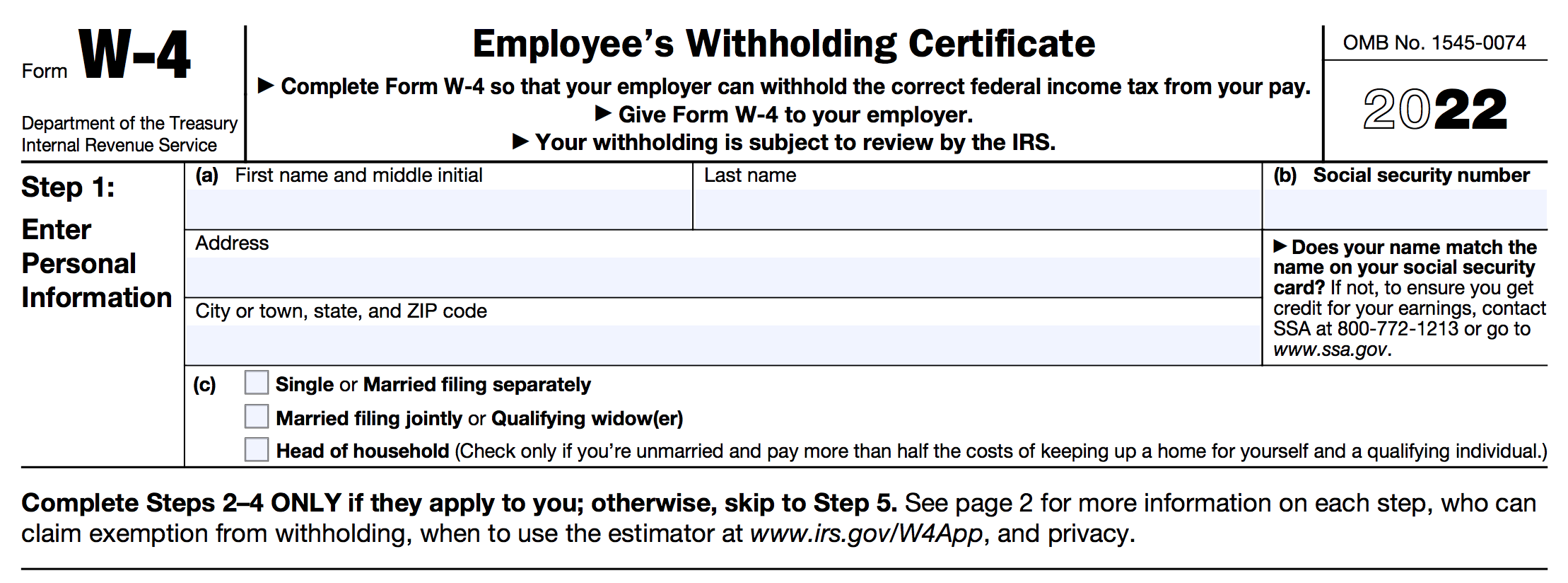

w-4-form-2022.com › basics-of-w-4-formW-4 Form: The Basics - w-4-form-2022.com Essentials of W-4 Form. Learn what you need to know before the form completion and check what you can do with our PDF template online. Basics of W-4 Form. Get . Basics of W-4 Form. Get Form. w-4-form-2022.com is not affiliated with IRS. PDF 2022 Form W-4 2022 Form W-4 Form W-4 Department of the Treasury Internal Revenue Service Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074 2022 Step 1:

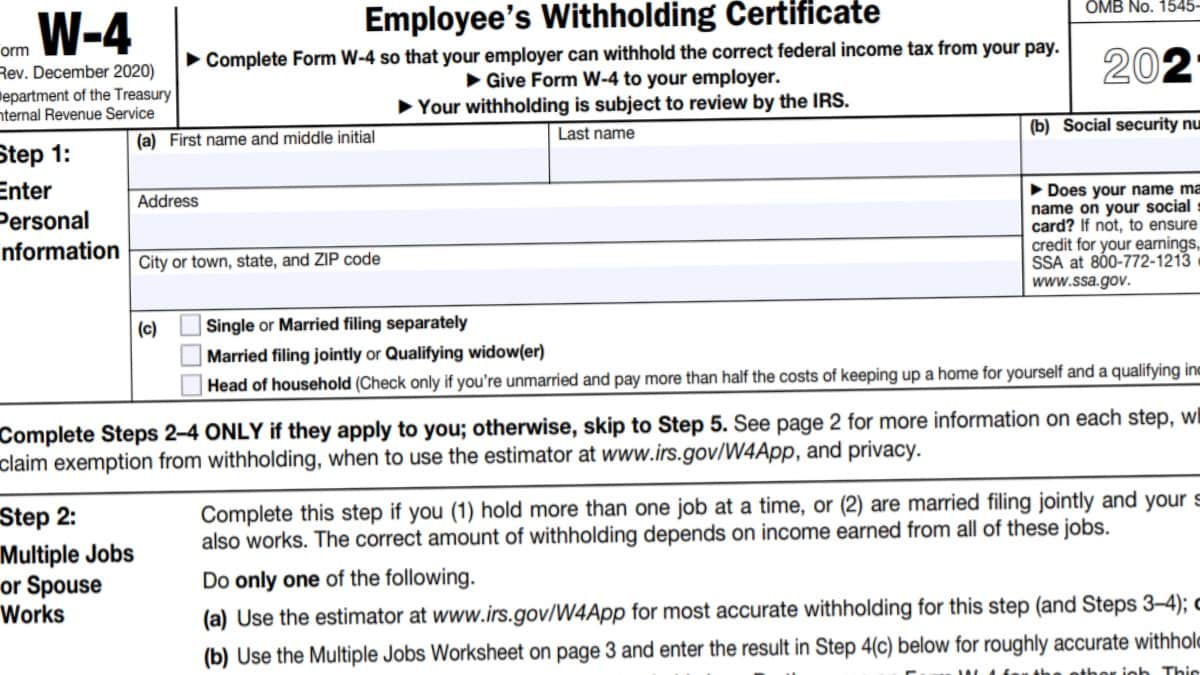

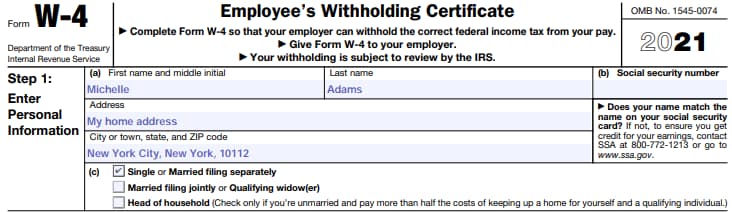

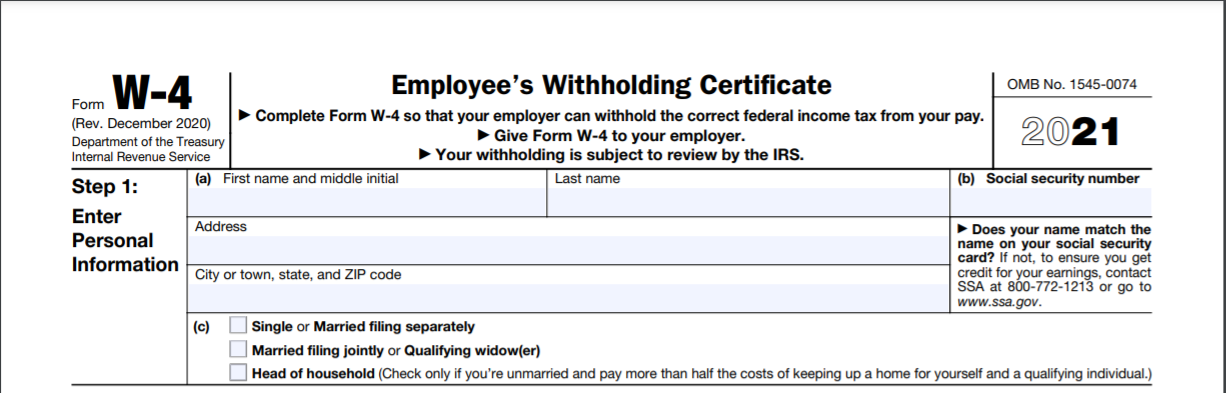

2022 W4 Form Printable, Fillable Online and How to Fill It? The 2022 W4 Form is a paper used for tax reporting purposes issued by the Internal Revenue Service (IRS). This document has a format title of ‘Employee’s Withholding Certificate’ and it informs about the amount of tax to withhold from the employees’ every single paycheck. The employers use this form to calculate and report certain taxable income to the IRS on behalf of …

W4 form 2022

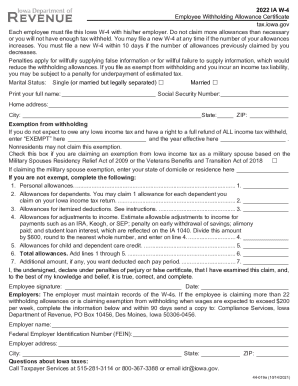

Michigan Form MI-W4 (Employee's Michigan Withholding ... Reset Form MI-W4 (Rev. 12-20) EMPLOYEE’S MICHIGAN WITHHOLDING EXEMPTION CERTIFICATE STATE OF MICHIGAN - DEPARTMENT OF TREASURY This certificate is for Michigan income tax withholding purposes only. Read instructions on page 2 before completing this form. 41. Full Social Security Number Issued under P.A. 281 of 1967. 4. Driver’s License … PDF IA W-4 (44109) - tax.iowa.gov 2022 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov 44-019a (10/14/2021) Each employee must file this Iowa W-4 with his/her employer. Do not claim more allowances than necessary or you will not have enough tax withheld. You may file a new W -4 at any time if the number of your allowances increases. How to Fill Out W-4 Tax Withholding Form in 2022 - AOTAX.COM For most, it is essential to fill out Form W-4 for 2022 to avoid being slammed with a large tax bill or a giant refund while filing tax returns in 2023. Saving on colossal tax bills could enable a more productive and profitable investment of the same money or invest in other essential expenses during the year by simply filling out a W-4 form.

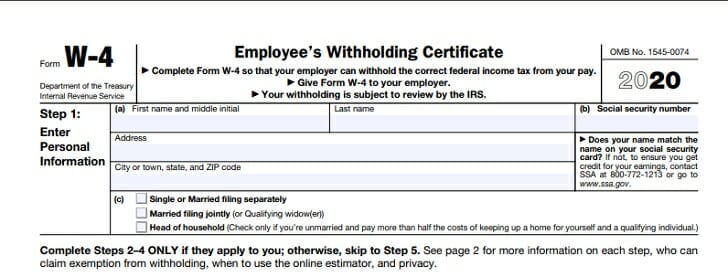

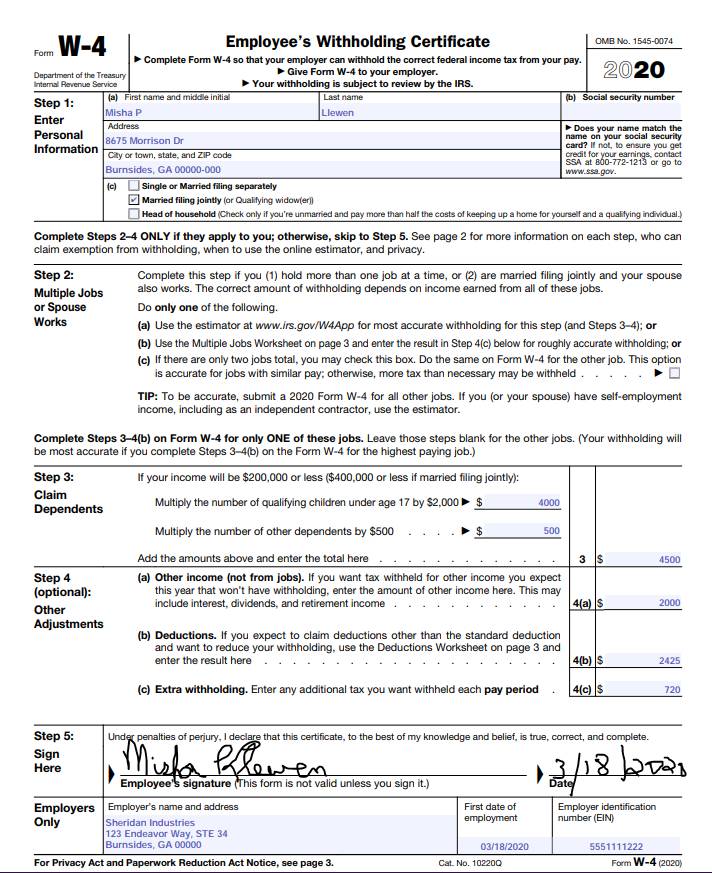

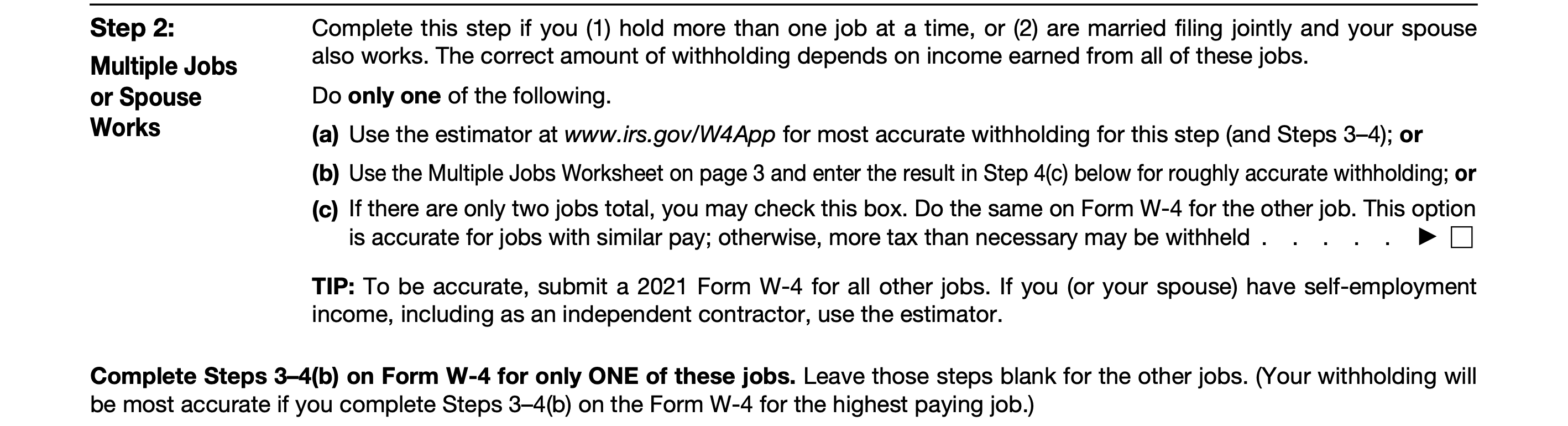

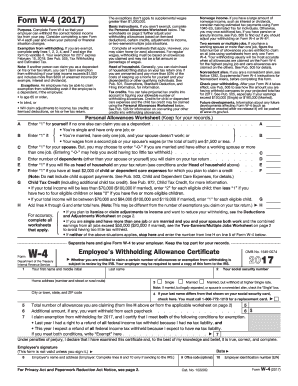

W4 form 2022. PDF South Carolina Employee'S Withholding Allowance ... Your exemption for 2022 expires February 15, 2023. If you are a military spouse and you no longer qualify for the exemption, you have 10 days to update your SC W-4 with your employer. Filers with multiple jobs or working spouses: You will need to file an SC W-4 for each employer. 2022 New Federal W-4 Form | No Allowances, Plus ... This new Form W-4 is divided into five steps: Enter Personal Information Multiple Jobs or Spouse Works Claim Dependents Other Adjustments Sign Here The IRS only requires that employees complete Steps 1 and 5. Steps 2 - 4 are reserved for applicable employees. › forms-pubs › about-form-w-4About Form W-4, Employee's Withholding Certificate ... Information about Form W-4, Employee's Withholding Certificate, including recent updates, related forms and instructions on how to file. Form W-4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay. 2022 Withholding Tax Forms If you received a Letter of Inquiry Regarding Annual Return for the return period of 2021, visit MTO to file or access the 2021 Sales, Use and Withholding Taxes Annual Return fillable form.. Fillable Forms Disclaimer Many tax forms can now be completed on-line for printing and mailing. Currently, there is no computation, validation, or verification of the information you enter, and you are ...

Forms and Publications (PDF) - IRS tax forms 2022 12/30/2021 Form W-4 (sp) Employee's Withholding Certificate (Spanish version) 2022 01/12/2022 Form W-4P: Withholding Certificate for Pension or Annuity Payments 2022 01/31/2022 Form W-4R: Withholding Certificate for Retirement Payments Other Than Pensions or Annuities W-4 Form 2022 Printable - 2022 W4 Form 18/01/2022 · W-4 Form 2022 Printable - 2022 W4 Form - The W4 form is paper utilized for tax reporting purposes issued by the Internal Revenue Service (IRS). The document is formatted with a name of 'Employee's withholding Certificate which explains the amount of tax which employers have to withhold from the employees' each pay check. This › pub › irs-prior2022 Form W-4P Form W-4P 2022 Withholding Certificate for Periodic Pension or Annuity Payments Department of the Treasury Internal Revenue Service Give Form W-4P to the payer of your pension or annuity payments. OMB No. 1545-0074 Step 1: Enter Personal Information (a) First name and middle initialLast name Address City or town, state, and ZIP code › articles › personal-financeW-4 Form: How to Fill It Out in 2022 - Investopedia Feb 08, 2022 · 2022 Form W-4 Married Filing Jointly Income Tax Table. If you have three or more jobs combined between yourself and your spouse, then you will need to fill out the second part of the Multiple Jobs...

Forms and Publications (PDF) - IRS tax forms Form W-4S. Request for Federal Income Tax Withholding from Sick Pay. 2022. 12/22/2021. Form W-4R. Withholding Certificate for Retirement Payments Other Than Pensions or Annuities. 2022. 01/03/2022. Form W-4P. PDF W-4MN, Minnesota Employee Withholding Allowance/Exemption ... Federal Form W-4 will not determine withholding allowances used to determine the amount of Minnesota withholding. Employees completing a 2022 Form W-4 will need to complete 2022 Form W-4MN to determine the appropriate amount of Minnesota withholding. Lock-In Letters About Form W-4V, Voluntary Withholding Request | Internal ... About Form W-4V, Voluntary Withholding Request. If you receive any government payment shown below, you may use this form to ask the payer to withhold federal income tax. Unemployment compensation (including Railroad Unemployment Insurance Act (RUIA) payments), Social security benefits, Social security equivalent Tier 1 railroad retirement benefits, Department of Revenue Services State of Connecticut Form ... Sign and return Form CT-W4 to your employer. Keep a copy for your records. 1. ... IP 2022(1). Mail copies of Forms CT‑W4 meeting the conditions listed in IP 2022(1) under Reporting Certain Employees to: Department of Revenue Services PO Box 2931 Hartford CT 06104‑2931 Report New and Rehired Employees to the Department of Labor New employees are workers not …

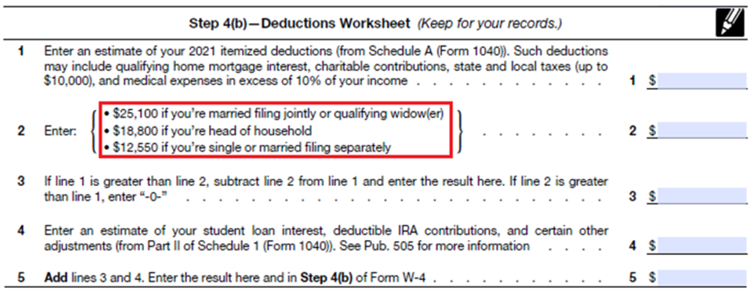

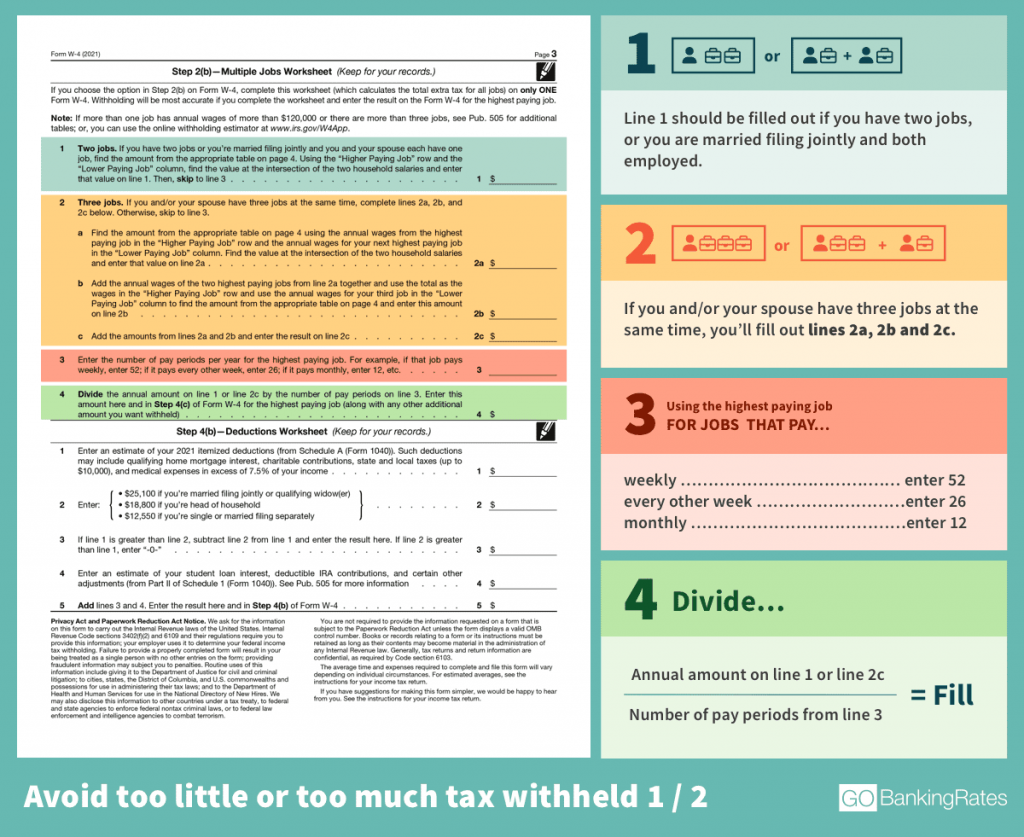

PDF 2022 Form W-4 - marylandtaxes.gov Form W-4 (2022) Page 3 If you choose the option in Step 2(b) on Form W-4, complete this worksheet (which calculates the total extra tax for all jobs) on only ONE Form W-4. Withholding will be most accurate if you complete the worksheet and enter the result on the Form W-4 for the highest paying job.

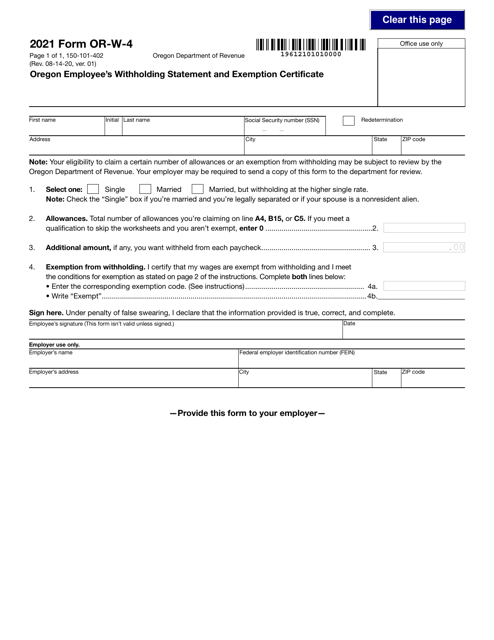

PDF 2022 Form OR-W-4, Oregon withholding Instructions, 150-101 ... 2022 Form OR-W-4, Oregon withholding Instructions, 150-101-402-1 1511421 ev 11321 1 of 7222 o 4 o Purpose of this form Use Form OR-W-4 to tell your employer or other payer how much Oregon income tax to withhold from your wages or other periodic income. Instructions for employer or other payer.

W-4 2022 Tax Withholding Form for Employees - W-4 Forms ... Learn more about how to file Form W-4 in 2022 here. Fill out Form W-4 online. You can fill out Form W-4 online through our PDF editor. It's an effective method to file Form W-4, especially if you're anticipating to e-mail the document to your employer. Additionally, you can print out a paper copy with the information you entered on the form ...

2022 W-4 and State Withholding Forms 2022 W-4 and State Withholding Forms. All 2022 new hires must complete a W-4 and some states have released new withholding forms. Unless changes are required, employees who have submitted a W-4 anytime before 2022 are not required to submit a new form. Employers will compute withholding based on information from the employee's most recently ...

W4 tax form 2022 | w-4 tax form. How to fill out w4 tax ... W4 tax form 2022 | w-4 tax form. How to fill out w4 tax form 2022. Other W-4 videos:W4 instructions W4 Single 2022W4 Married filing jointly 2022How to fill ...

› article › taxesHow to Fill Out a W-4 in 2022: Guide and FAQs - NerdWallet Mar 11, 2022 · Once completed, give the signed form to your employer's human resources or payroll team. Page 1 Form W-4 (2022) What should I put on my W-4? If you got a huge tax bill when you filed your tax...

W4 Form 2022 - W-4 Forms - TaxUni 29/01/2022 · Get W4 Form 2022 Every worker in the United States should file Form W4 accurately so that the taxes withheld from their income throughout the tax year is appropriate with their tax liability. If too much or less tax is withheld from the wages every pay period, the outcome of this won’t be feasible.

W4 federal tax form in , DURRËS - , W4 federal tax form ... Find the best W4 federal tax form around ,DURRËS and get detailed driving directions with road conditions, live traffic updates, and reviews of local business along the way. ... DURRËS 2022 , Vanadzor, LORI 2022 ,, LOWER AUSTRIA 2022 ,, DHAKA DIVISION 2022 ,, 2022 ,, CENTRAL HUNGARY 2022 ,, AKERSHUS 2022 , Auckland, AUCKLAND 2022 ,, 2022

PDF 2022 IA W-4 Employee Withholding Allowance Certificate 2022 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov 44-019a (10/14/2021) Each employee must file this Iowa W-4 with his/her employer. Do not claim more allowances than necessary or you will not have enough tax withheld. You may file a new W -4 at any time if the number of your allowances increases.

blank w4 form 2022 - W4 Form 2022 Blank W4 Form 2022 - W4 Form 2022 - Complete the Form W-4 to ensure that your employer is able to withhold the appropriate federal income tax from your pay. Think about filling out a new Form W-4 each year as well as when your personal or financial circumstances change. For the latest information about the latest developments in relation …

How to Fill Out a W4: 2022 W4 Guide - Gusto Taxpayers who fill out the 2022 W-4 form are less likely to wind up with a large tax bill or a giant refund when they file tax returns in 2023—money that could have been invested or spent on essential expenses throughout the year.

lakeshorefarmmanagement.com › files › 2022_w-4_english2022 Form W-4 - lakeshorefarmmanagement.com Title: 2022 Form W-4 Author: tinas Created Date: 1/25/2022 3:19:17 PM

PDF 2022 Form W-4 - IRS tax forms 2022 Form W-4 Form W-4 Department of the Treasury Internal Revenue Service Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Give Form W-4 to your employer. Your withholding is subject to review by the IRS. OMB No. 1545-0074 2022 Step 1:

w-4-form-2022.comW-4 Form 2022 - Fill out PDF The W-4 will show you all the information in one document that the IRS knows. W-4 Forms for 2022 IRS W-4 Forms for 2022 What will my W-4 Form say? The W-4 will be completed by completing the following questions: "Do you work for an employer? (Employer is the Federal government only) "If Yes, please explain…"

PDF SKM 368e22011409370 Title: SKM_368e22011409370 Created Date: 1/14/2022 9:37:08 AM

PDF Oregon Withholding Statement and Exemption Certificate 2022 Form OR-W-4 Oregon Withholding Statement and Exemption Certificate Office use only Page 1 of 1, 150-101-402 (Rev. 09-30-21, ver. 01) Employer's name Employee's signature (This form isn't valid unless signed.)

How to Fill Out W-4 Tax Withholding Form in 2022 - AOTAX.COM For most, it is essential to fill out Form W-4 for 2022 to avoid being slammed with a large tax bill or a giant refund while filing tax returns in 2023. Saving on colossal tax bills could enable a more productive and profitable investment of the same money or invest in other essential expenses during the year by simply filling out a W-4 form.

PDF IA W-4 (44109) - tax.iowa.gov 2022 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov 44-019a (10/14/2021) Each employee must file this Iowa W-4 with his/her employer. Do not claim more allowances than necessary or you will not have enough tax withheld. You may file a new W -4 at any time if the number of your allowances increases.

Michigan Form MI-W4 (Employee's Michigan Withholding ... Reset Form MI-W4 (Rev. 12-20) EMPLOYEE’S MICHIGAN WITHHOLDING EXEMPTION CERTIFICATE STATE OF MICHIGAN - DEPARTMENT OF TREASURY This certificate is for Michigan income tax withholding purposes only. Read instructions on page 2 before completing this form. 41. Full Social Security Number Issued under P.A. 281 of 1967. 4. Driver’s License …

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png)

0 Response to "42 w4 form 2022"

Post a Comment